Form for Taxpayers

Taxpayers need to file a tax return every year, and a tax return contains a number of different expenses that need to be accounted for. Some of these expenses are ones that the taxpayer incurred during the year. Other expenses are ones that taxpayers received from other sources.

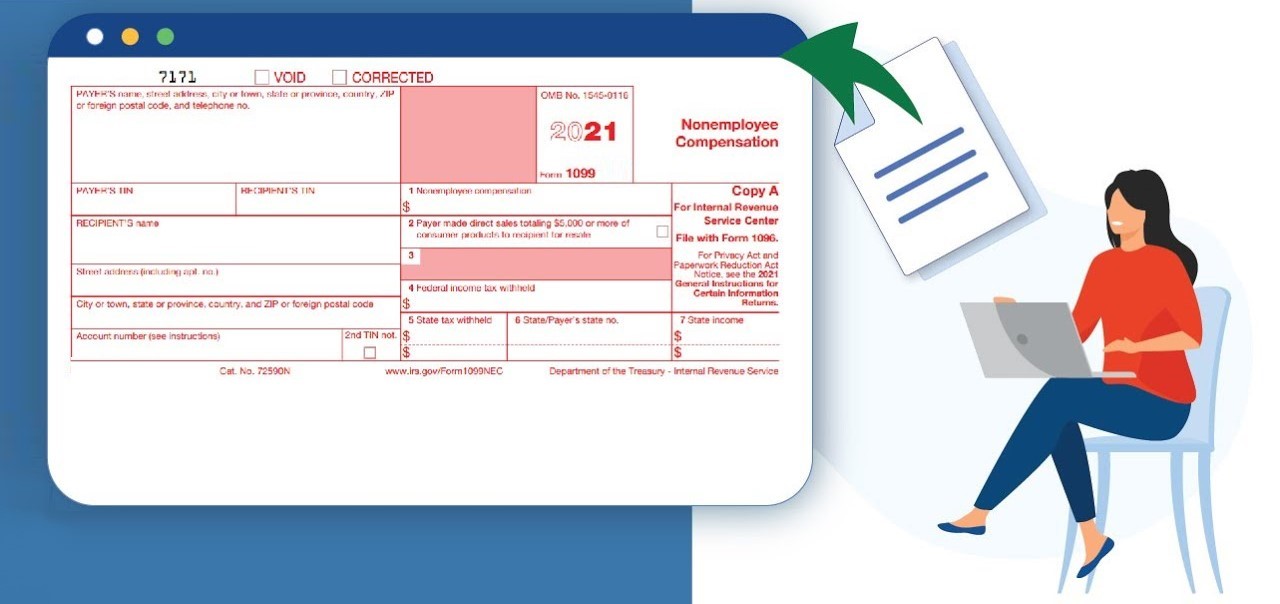

1099 Form is a tax document used to account for many types of expenses, one of which is payments for the use of property or services. In the case of property, this usually refers to rental payments. If someone rents out property, they need to report payment on the document. When they do, they’ll receive a Form 1099-MISC from the person they paid. Similarly, if someone has a service, say, lawn care, they will report the payments for service.

Step-by-Step Guide to Filling

- List the company's name, address, and company's tax identification number

- Write the name(s) of the person(s) to whom documents are being issued

- Fill out the next blocks

- Sign your blank

- Send document to IRS

Report Payments

It’s used to report payments made to contractors, to report self-employment earnings, to report royalties, and to report miscellaneous income. It’s sent to the IRS by businesses or other payers to report income payments to contractors, vendors, and other recipients.

IRS uses the information on the 1099 Tax Form to help to enforce tax regulations, to determine how much to withhold from payee’s income tax, and to determine how much to credit the payee’s Social Security account.

Certain payers are required to send out free 1099 Tax Forms to print for various reasons. For example, certain payments of $600 or more made to a non-employee are required to be reported.

Who Sends IRS Form 1099?

Eligible businesses are required to send a 1099 form printable free to any person or business to whom the business has paid a total of $600 or more in a given year for a type of service. This includes payments for services as a contractor, independent contractor, self-employed, and other types of service to a business. Individuals who are paid as a W-2 employee do not receive a Form 1099 printable. If a business has paid of $500 to a non-employee, the business is required to send the individual a blank 1099. This document is typically sent to the individual's home address. Document will report the total amount of payments made to individuals, date the payments were made, and type of services that were provided. Printable 1099 Form free will be sent to individuals before January 31 of the following year.

1099-NEC vs. 1099-MISC

Both types of fillable 1099 MISC form are required to be filed with the IRS and to be provided to the recipients of reportable payments.

1099-MISC reporting requirements are in effect for payments made in the course of your trade or business that are in excess of $600. While this includes payments made to corporations and partnerships, it does not include payments made to nonresident aliens, payments made in the course of a trade or business conducted by a federal, state, or local government, or payments made to tax-exempt organizations.

FAQ

- How to fill out a free 1099 printable form?It’s a type of income tax document used by independent contractors to report miscellaneous income from a company. Document is filed with the IRS to report all of the income that is not related to a W-2. IRS provides a 1099 online form to the company that paid the independent contractor. Company then sends a copy of this document to the independent contractor. It’s a document for reporting self-employment income from a company.

- Why is the printable 1099 Form important?It’s important because it is used to report income, which in turn is used to calculate the amount of taxes owed.

- What information can be found on a fillable 1099?Income, either as a wage or as a business income, which is reported to the Internal Revenue Service through a document.

- What does Tax Form 1099 stand for?It’s a document that an employer or a company or a government agency will send to a taxpayer to report the amount of income that is being paid to them.

Popular Form 1095-A Versions & Alternatives

-

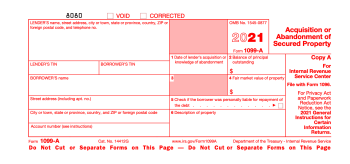

![image]() 1099-A Form Online Form 1099-A is a form that is used to report cancellation of debt payments. It is used to report to the IRS the total amount of debt that is forgiven. If a person's debt is forgiven, they are required to report the amount of debt that was forgiven to the IRS. The Form 1099-A is used to report the f... Fill Now

1099-A Form Online Form 1099-A is a form that is used to report cancellation of debt payments. It is used to report to the IRS the total amount of debt that is forgiven. If a person's debt is forgiven, they are required to report the amount of debt that was forgiven to the IRS. The Form 1099-A is used to report the f... Fill Now -

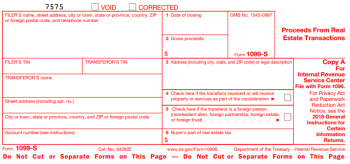

![image]() Printable Form 1099-S Form 1099-S is used to report cancellation of debt income. This form is filed by the party to whom the debt was canceled. The party cancelling the debt is required to file a form 1099-S to the IRS for any debt that is canceled which is in excess of $600. The IRS does not collect any tax on this type... Fill Now

Printable Form 1099-S Form 1099-S is used to report cancellation of debt income. This form is filed by the party to whom the debt was canceled. The party cancelling the debt is required to file a form 1099-S to the IRS for any debt that is canceled which is in excess of $600. The IRS does not collect any tax on this type... Fill Now