Printable Form 1099 S for 2021

Form 1099-S is used to report cancellation of debt income. This form is filed by the party to whom the debt was canceled. The party cancelling the debt is required to file a form 1099-S to the IRS for any debt that is canceled which is in excess of $600. The IRS does not collect any tax on this type of income. However, the debtor may have a tax liability for this income on their individual income tax return.

- What is the 1099-S Form?

A 1099-S Form is a type of IRS Form 1099 that is used to report proceeds from the sale of real estate. - Why do I need to fill out a 1099-S Form?

You need to fill out a form if you are a real estate investor who owns a rental property that was sold for over $250,000. You are then required to file a 1099-S form with the IRS.

Related Forms

-

![image]() 1099 Form Taxpayers need to file a tax return every year, and a tax return contains a number of different expenses that need to be accounted for. Some of these expenses are ones that the taxpayer incurred during the year. Other expenses are ones that taxpayers received from other sources. 1099 Form is a tax document used to account for many types of expenses, one of which is payments for the use of property or services. In the case of property, this usually refers to rental payments. If someone rents out... Fill Now

1099 Form Taxpayers need to file a tax return every year, and a tax return contains a number of different expenses that need to be accounted for. Some of these expenses are ones that the taxpayer incurred during the year. Other expenses are ones that taxpayers received from other sources. 1099 Form is a tax document used to account for many types of expenses, one of which is payments for the use of property or services. In the case of property, this usually refers to rental payments. If someone rents out... Fill Now -

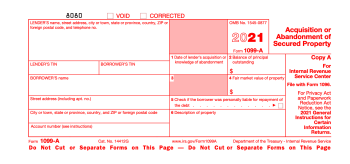

![image]() 1099-A Form Online Form 1099-A is a form that is used to report cancellation of debt payments. It is used to report to the IRS the total amount of debt that is forgiven. If a person's debt is forgiven, they are required to report the amount of debt that was forgiven to the IRS. The Form 1099-A is used to report the following types of income: Acquisition or abandonment of secured property Cancellation of debt Deferred compensation Discharge of indebtedness Income from the discharge of qualified principal residence indebtedness Income from the sale of qualified small business stock Fill Now

1099-A Form Online Form 1099-A is a form that is used to report cancellation of debt payments. It is used to report to the IRS the total amount of debt that is forgiven. If a person's debt is forgiven, they are required to report the amount of debt that was forgiven to the IRS. The Form 1099-A is used to report the following types of income: Acquisition or abandonment of secured property Cancellation of debt Deferred compensation Discharge of indebtedness Income from the discharge of qualified principal residence indebtedness Income from the sale of qualified small business stock Fill Now